This article is about how to extend the tax filing deadline up to 17 October. This article explains how to file extra time for Taxes 2022.

What is the tax return date? What are the most recent updates? Every year, on the 15th of April, taxes are submitted within the U. s States. The date for filing extensions and tax submissions in 2022 clashed. Because of the same date on the Extension form as the tax submission, the submission date is now 18 April. After Monday. You can file extra time for Taxes 2022 if you feel any problems before to submit your return free of penalties.

Updates on File extension dates

Due to the pandemic, and other dates clashes the final date for tax submission is now 18 April. Similar to almost every year, the tax submission deadline for this year is 15 April.

In general, the ITR file must be submitted before the weekend ends. This will likely occur closer to 15 April. This year, however, the deadline for filing an extension form was on 15 April. Therefore, these dates for extension and submission fell around the weekend. This situation was rectified by the Government, who granted an extension of tax filing deadline.

How to File Extra Time for Taxes 2022 Online

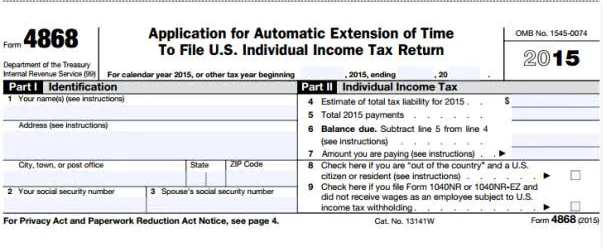

You can fill out an application 4868 to launch additional time. Although you can apply for additional time until 17 October, this date does not include Due Tax. Except for 2010 revenue, this date extension is only available.

Pre-owned tax must be paid promptly to avoid interest and penalties. You can fill this form online at the IRS website. This e-file tax extension can be applied for free. If you were simply built with a due amount, the last date for filing an e-file of tax extension was 18 April 2022. You can delay your tax payment by one day and spend it with higher interest or even big penalties.

Benefits of filing extra time for taxes 2022

If your tax arrives late, you won’t be able to file your taxes on time. Each deadline is subject to penalties and interest. This file extension program is associated to help with the specific problem of filing returning. You can avoid penalties by filling out either the tax return through the due date or the extension form 488 before 18 April.

The extension form will allow you to pay your tax return within a few extended deadlines provided by the government. This article will provide you with information on how to File extra Time for Taxes 2022 online. The deadline for filing extra time can be moved up to 18 April. If you have not filed your tax, don’t worry. You can apply for an extension. For those with any past due.

Conclusion

Tax payers are able to fill out their taxes without penalty due to extension of dates. To avoid penalties, however, you must send it in by 18 Are you familiar with tax filing? You can leave comments below with your thoughts and suggestions. You can file extra time for Taxes 2022 by going to.