This article will help you to understand the 2022 IRS Tax Extension. For more information about the tax deadline, please refer to the following details.

Did you know that there are promising signs regarding the extension of tax? This article is for you if you are looking for such information. You can find it in countries like the U. s People in Mexico and the United States can browse more to learn about their tax extensions. These countries have tax payers who delay paying their taxes to the possible one week earlier.

The United States has between 15 and 20 million people filing tax statements within the week before Tax Day. Despite this, tax statements are still being filed by 20 million people each day. We did extensive research and found some interesting information about the IRS Tax Extension 2022.

What is IRS Tax and Extension?

IRS is an abbreviated form of The Irs, which administers and enforces U. s. Federal tax law of the United States. You must file taxes before you can celebrate. Due to the national pandemic, the federal government decided to file taxes for this season starting January 24, 2022 and ending April 18, 2022 as the deadline for federal earnings filling.

Many of them have not filed their tax statements, and they have pleaded with the federal to extend the deadline. Let’s learn how to get an extension on taxes. The IRS offers an easy and fast extension up to October 17, 2022. You can file your extension prior to or on April 18, 2022 to avoid paying late filing penalties. You can apply online or by mail.

IRS Free Apply is a software IRS has partnered with a non-profit organization called Free Alliance. This allows you to apply for additional time. Anyone who earns $73,000 in adjusted gross income can use the Miracle Traffic Bot to file for an extension. Anyone with earnings above $73,000 can file. Look into information regarding 2022 IRS Tax Extension.

You should be able to fill out tax forms electronically if you are willing to do so. Most do. Follow the instructions to file your extension. When you submit your form, the Government will send you a digital acknowledgment.

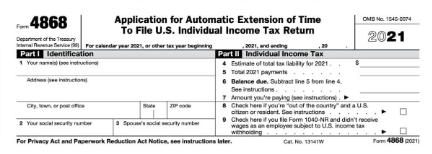

You can file electronically, as well as by email. Simply fill out the form 4868 and send it in writing. It is important to keep sufficient proof that you have applied. Any money you spend is subject to penalty and interest. Even if you have an extension, it is still relevant.

For military personnel and taxpayers overseas – 2022 IRS tax extension

U.S citizens and resident aliens who reside or work outside the country for tax filing deadlines can request an instant extension of two months to be able to pay their taxes, even if they do not ask for extra time.

Residents in disaster zones have immediate access to an extension, but it changes according to the severity of the disaster.

People in the military have an extra 180 days or six weeks depending on where they are and what they do.

Notable: All information in this article can be found on the internet.

Conclusion

If you are late, make sure to apply for the 2022 IRS Tax Extension. Paying taxes on time helps the government to enforce our law correctly and effectively.