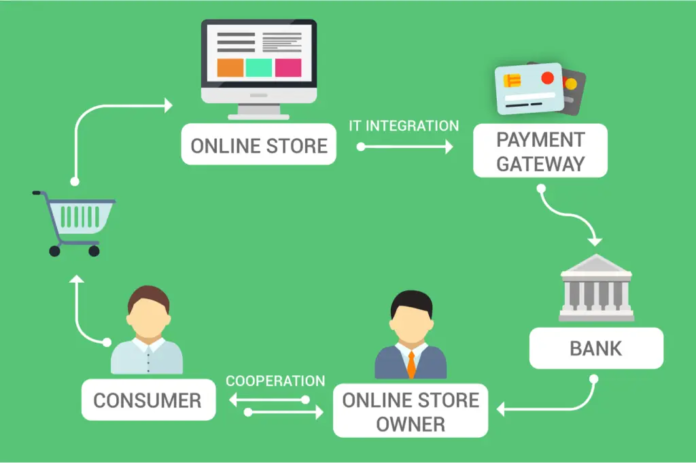

A payment gateway is necessary for your business to make payments. It is a service that businesses use to process credit cards and other electronic payments securely. When a customer makes a purchase from a business, the payment gateway encrypts the customer’s information and sends it to the credit card processor. The processor then verifies the customer’s information and approves or declines the transaction. There are many benefits of using a payment gateway for businesses. Payment gateways help to protect businesses from fraud by encrypting customers’ information and verifying their identities.

What is a Payment Gateway?

A payment gateway is a service that allows businesses to accept online payments. Payment gateways encrypt sensitive information, such as credit card numbers, to ensure that it is secure when transmitted over the internet. Most payment gateway providers offer additional features, such as fraud protection and recurring billing. Payment gateways are an essential part of doing business online, and they can help you increase sales and customer satisfaction. Businesses can safely transfer funds to their customers through payment channels, and lenders can securely receive transaction data. The payment gateway, which encrypts the data before delivering it, safely transmits client data from the client to the business and the payment system. The procedures are clear and straightforward to follow. However, there are considerable hazards. You can secure your business against online fraud and increases customer confidence by employing Acuitytec risk management.

How a payment gateway benefits your business?

A payment gateway is a service that helps businesses accept credit cards and electronic payments. By using a payment gateway, businesses can streamline their payment processing, reduce their costs, and offer their customers a more convenient way to pay. There are many benefits of using a payment gateway for your business. Perhaps the most obvious benefit is that it can help you save money on your credit card processing fees. It allows you to process credit card payments directly through your website, without having to use a third-party processor. This means that you won’t have to pay the extra fees that come with using a third-party processor. Another benefit of using a payment gateway is that it can help you speed up your payment processing. When you use a third-party processor, your customers have to leave your website and go to the processor’s website to complete their purchase. This can add extra time and steps to the checkout process, which can frustrate customers and lead them to abandon their purchase altogether. With a payment gateway, customers can stay on your website throughout the entire checkout process, making it faster and easier for them to complete their purchases.

In addition to saving money and speeding up your payment processing, using a payment gateway can also help you improve your customer service. A payment gateway gives you the ability to accept a wide range of payments, including major credit cards, debit cards, electronic checks, and even PayPal payments. This means that you can offer

What are the different types of payment gateways?

A payment gateway is a service that allows businesses to process online payments. Payment gateways encrypt sensitive information, such as credit card numbers, to ensure that it is safely transmitted between the customer and the merchant. There are several different types of payment gateways, each with its own advantages and disadvantages. The most popular types of payment gateways are:

1. Merchant Account Payment Gateway: A merchant account is a type of bank account that allows businesses to accept credit card and electronic check payments. Merchant accounts are set up through banks or other financial institutions.

2. Third-Party Payment Processor: A third-party payment processor is a company that processes credit card payments on behalf of businesses. These companies typically charge a per-transaction fee and may also require businesses to set up a merchant account.

3. Credit Card Processor: A credit card processor is a company that processes credit card payments for businesses. These companies typically charge a monthly fee and may also require businesses to set up a merchant account.

4. Online Payment Service Provider: An online payment service provider is a company that provides businesses with the ability to accept online payments. These companies typically charge a monthly fee and may also require businesses to set up a merchant account

How can you set up a payment gateway for your business?

If you are running an online business, then you will need to set up a payment gateway so that your customers can pay for goods and services. A payment gateway is a third-party service that allows you to accept credit card and electronic check payments from your customers.

There are many different payment gateway providers available, so you will need to do some research to find one that best suits your needs. Once you have selected a provider, you will need to sign up for an account and obtain the necessary credentials.

Once you have set up your account, you will need to integrate the payment gateway into your website or shopping cart system. This process will vary depending on which platform you are using, but there are usually clear instructions provided by the gateway provider.

After the payment gateway is set up and integrated, you will be able to start accepting payments from your customers. It is important to keep in mind that each transaction will incur a fee from the payment processor, so you will need to factor this into your pricing.

Conclusion

If you’re running an online business, then you know how important it is to have a reliable payment gateway. A payment gateway helps to process transactions quickly and securely, and it also provides customer support in case there are any issues.