How does investing work? What are the relationships between return and risk? Understanding the relationship between return in investing and risk will allow you to make more informed investment decisions.

It is well-known that there are several asset types, including gold, bonds, and equities. Understanding how to identify these assets in terms return and risk is essential when you own them. This will allow you to adjust your investment target and investment process more easily.

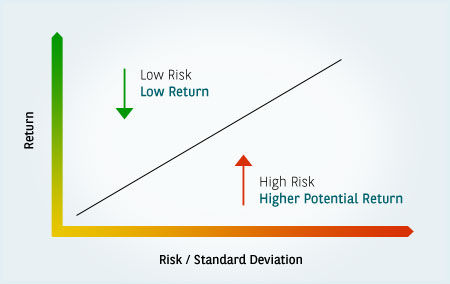

Economists are used to saying there is no “free meal”. To put it another way, high returns on investments come with substantial risk. Safe investments, however, have low returns. This is the risk-return relationship.

Return and Risk: What is the Relationship?

You can also diversify your portfolio by combining different investment instruments to reach your goal. What investment mix is right for you? The most important factors in investing are returns, and risk.

Your expectation of the return on your investment, also known as yield, is what you call it. The risk of not receiving the expected return, or a lower amount than you expect, is called risk. In other words, risk refers to the volatility of an investment.

Four types of main asset classes

- Equity: This is the type of investment that consists of ownership in a company. It can also be known as shares.

- Bonds: Investments like debt. By buying a bond you can give a loan to a company, or government, and get interest. The initial capital will be returned after the period.

- Alternative Investments: This category covers investment in property and commodities as well as gold. Sometimes this asset class is more risky than equities or bonds. However, expected returns can have different trends and patterns than equities and bond. This asset class can be used for diversification.

- Cash: That’s right, cash. Cash can also be used as a short-term, liquid investment in asset classes. Short-term deposits can be made in banks for easy access.

Why do you choose this risk-return combination?

Investors are willing to accept higher risk for greater returns. An investor who wants to improve his portfolio’s profitability must take on more risk.

Each investor is more risk-phobic than another . He has his own understanding of the “optimal return” risk / return.

The amount of savings will affect how risky the investor is willing to take on. The amount saved can be large enough to make risky investments. Investments with high yield, but safe, are preferable if there is a low level of savings.

Bonds issued by certain countries that are considered safe to invest in, such the United States, Germany, and France to fund their public debt, are the most risky assets on financial markets.

Volatility

It is important to assess risk by assessing volatility.

Volatility refers to changes in financial securities’ prices: bonds, currencies and stocks. The more volatile a stock, either in terms of its price or relative to other news items about the company and the markets, the greater the risk. High volatility indicates that the price fluctuates a lot and the associated risk with its value. Stock prices are generally more volatile than bonds. Statistics show that time decreases stock volatility. The risk is reduced by long-term stock holding.

The risk premium

It’s the distinction between the yield of a government bonds and that of a riskier investment such as a corporation bond or stock. This is also the additional compensation that the investor receives in exchange for agreeing to purchase these bonds, or these shares, rather than subscribe to any government bonds. Bond yields are comparable to those of government bonds. It is always greater because there is a higher risk of default by the borrower.

The rate of change in interest rates will affect the price that an investor can sell his bond. Because it yields a lower rate than new bonds, it will lose value if the rates have risen.

Equity investments are generally considered to be more stable than bonds, due to the higher risk they pose.

The more difficult a company becomes, the more doubts it has about its ability repay its loans (bonds), or generate profits (shares). Therefore, its share price and bond price will drop. .

The historical analysis of stock returns from the United States, which is also valid for other developed countries, shows that there has been a real, or at least a significant, increase in stock returns. The inflation-adjusted annual return includes between 6.5%-7%. This is significantly higher than the yield on long term government bonds (1.7%). The risk premium is the difference of 4.9 points.

When we compare, as in this study, the annual return on stocks versus bonds over nearly two centuries (XIX th, XX th centuries), it is clear that there is more variation between the best and worst stock performances than between the best bond yields. This would show that equities can be both more profitable than bonds and are also more risky.

The paradox of action

Many studies have proven that stocks are less risky than bonds in the long term, while they offer higher returns.

The principle is that the good years would outweigh any bad. Stocks are less risky than bonds, and may be more suitable for the most cautious investors. Although the risk of a total market crash could explain the higher return on equities, it is possible that bonds have a lower profitability ratio than equities.

Stocks are certainly not more risky in the long-term despite having higher returns… However, it is necessary to protect against bad short-term performance. It is best to have a variety of assets. portfolio . This will lower the level risk and, undoubtedly the expected average returns. It also makes it possible for you to be located higher in terms return while still respecting your “levels of risk aversion”.

The placement duration

Multiple studies (from and INSEE), have shown that the chances of making a return increase with the amount of time invested. Additionally, the risk reductions associated with an extended investment period are lower. However, this can decrease the likelihood of a particularly high peak profit.

These findings, as robust as they might be, were based on past data over medium and long periods. This does not allow us to predict future performance.

Ideal Investment Portfolio

The ideal portfolio will balance risk and return.

Consider this: You are looking to purchase a house within three years. Maybe you don’t want your money to go in risky investments. You want your savings available when you can pay the downpayment on the house.

You optimize security as well as lower returns. Your portfolio could be divided more toward bonds that are low-risk and cash and less towards equity.

If you have a long investment horizon, it may not be a problem to invest in a goal for 10 years.

You might consider adding more equity to the portfolio to maximize your return, rather than just a few bonds.

Understanding returns and risks is essential. Know the risks and returns before you buy any item of great worth.